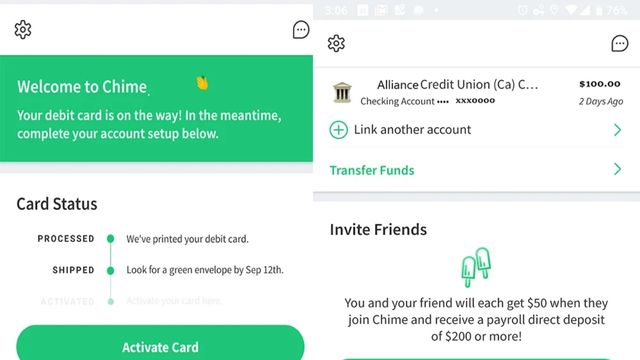

Chime, a fintech company, works with The Bancorp Bank, Stride Bank, and the FDIC to provide individuals with simple banking options.

purchase augmentin online

Chime users are not charged any overdraft fees, foreign transaction fees, monthly fees, hidden costs, or a minimum balance requirement.

Furthermore, Chime offers approximately 60,000 fee-free ATMs at a variety of well-known stores that you frequent, such as Walgreens, CVS, and 7-Eleven.

Chime also contributes to the creation of credit scores. Chime’s capacity to help consumers pay friends and family members who are not Chime subscribers is the most exciting of all products and services.

Chime allows you to deposit money straight into people’s bank accounts without incurring additional transaction costs.

The monthly maximum deposit amount at Chime is ,000, with daily deposits limited to ,000.

purchase elavil online

However, three deposits per day are permitted.

Chime Each Deposit Limit

The following is a list of the maximum amounts that can be transferred via Chime’s ACH service:

No cap exists on the number of transactions completed each day, regardless of whether the ACH transfer is started within or outside a financial institution.

The total amount of money transmitted this way is also restricted.

More to Read:

Instagram’s Finally Working on Protecting Users from Unsolicited Nude Photos

What Exactly is Newmods.co? Is Newmods Secure?

There is no restriction on the number of ACH transfers that can be made to the spending account through a mobile app or website, but there is a $200 daily cap on funds transfers. Additionally, there is a $1,000 monthly cap.

Chime’s Daily Deposit Limit

The maximum amount that can be deposited into your Chime account in a single day is $1,000.

Check Deposit Limit for Chime

Traditional paper checks are not available through Chime. However, the Chime Checkbook function allows users to send paper checks to payees who live in the US. Checks can be sent up to $10,000 per month and $5,000 at a time.

Chime’s Direct Deposit Limit

Chime does not offer a direct deposit option; nonetheless, Chime clients can access their funds up to two days earlier than customers of any other financial institution. Chime does not offer direct deposit.

Chime Direct Deposit Helps to Reduce Unemployment

You can take advantage of the following advantages with the Chime direct deposit spending account:

- There are no hidden costs, no minimum balance requirements, no monthly fees, and no foreign transaction fees.

- The debit card is free to use at over 38,000 MoneyPass and Visa Plus Alliance ATMs.

- When you use SpotMe to make debit card purchases, there will be no overdraft fees.

purchase lexapro online

- You can increase your savings by rounding up your purchases.

Transfer Limit for Chimes

The maximum amount that can be transferred through Chime monthly is $10,000.

Limit on Withdrawal of Chimes

There can only be a maximum of six transfers made from the savings account to the checking account during each statement cycle. This only applies to financial transactions completed online.

Comments are closed.