The Federal Reserve raised interest rates for the ninth time in a row on Wednesday. They did this to keep fighting high inflation, even though the collapse of two regional banks has caused stress in the banking industry.

Fed policymakers decided unanimously to raise the benchmark interest rate by a quarter point, to just under 5%. This will make it more expensive for people to get car loans or keep a balance on their credit cards.

Members of the Fed’s rate-setting committee think that rates may need to go up a little bit to keep prices stable. According to new projections that were also released on Wednesday, officials expect rates to go up by another 0.25% by the end of the year on average.

In a statement, the Fed said, “The Committee thinks that some additional policy tightening may be in order.”

Banking Collapses Had Set Off an Alarm

Some experts had asked the central bank to stop raising interest rates, at least for a while, so that they could figure out how the failure of Silicon Valley Bank and Signature Bank earlier this month would affect the economy.

In recent days, however, it seemed like the stress in the banking system was getting better. Janet Yellen, the head of the Treasury Department, said on Tuesday that big withdrawals from regional banks have “stabilized.”

In its monetary policy statement, the Fed said, “The U.S. banking system is strong and stable.”

Consumer prices, on the other hand, keep going up quickly. In February, the annual rate of inflation was 6%. This was down from 9.1% in June of last year, but it was still well above the Fed’s goal of 2%.

The rising cost of services like plane tickets and streaming TV subscriptions worries the central bank the most.

Fed chairman Jerome Powell told reporters after the meeting, “My colleagues and I are very aware that high inflation hurts people’s ability to buy things, especially those who are least able to pay more for things like food, housing, and transportation.”

Also Read: 6 Bank Accounts You Can Open With No Deposit

The Fed Is Under Pressure Over Bank Collapses

The Fed is also being looked at for how it supervised the two banks that failed. Fed officials are said to have found problems with the way Silicon Valley Bank handled risks years ago. However, the problems were not fixed, and the California bank had to be taken over by the U.S. government after a huge number of people tried to withdraw their money.

Michael Barr, the Fed’s vice chairman for supervision, said, “We need to be humble and do a careful and thorough review of how we supervised and regulated this firm.”

Barr is doing the study, and he said he would give a report by May 1. He will also talk to two committees of Congress next week. Some people have asked for an outside investigation into the Fed’s part in the failure of banks.

Powell told reporters on Wednesday, “It’s a 100% sure thing that there will be independent investigations.” “When a bank fails, there are usually investigations, which is fine with us.”

Elizabeth Warren, a Democrat from Massachusetts, and Rick Scott, a Republican from Florida, have both suggested that the Fed’s internal inspector general be replaced by an inspector from the outside, who would be chosen by the president.

Must Read: Fundi Banking Details: How Do I Check My Fundi App Balance?

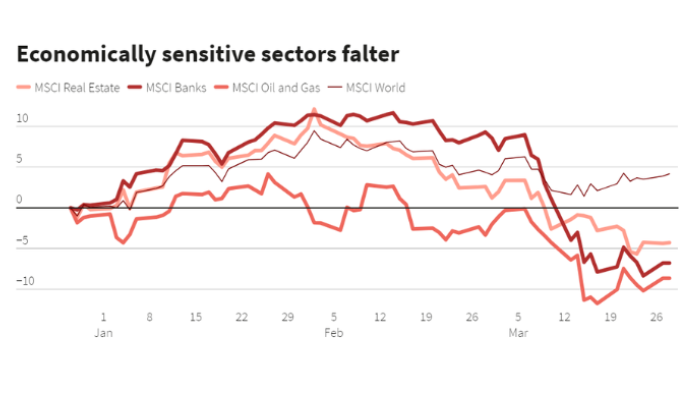

Recession Fears Have Grown Over Banking Turmoil

When choosing how much to raise interest rates in the future, the Fed will have to think about how the failure of the two regional banks will affect the economy.

Since Silicon Valley Bank and Signature Bank went out of business, other banks are likely to be more careful about giving out loans.

“Recent events are likely to make it harder for people and businesses to get credit, which will hurt economic activity, hiring, and inflation,” the Fed said in a statement. “It’s not clear how big these effects will be.”

When things get harder to borrow, like when interest rates go up, the economy grows more slowly.

Kathy Bostjancic, the chief economist at Nationwide, said, “Credit is the oil that makes small businesses and the economy run.”

“If that credit starts to get cut off,” she said, “I think you can expect a pretty big pullback.”

That could help the Fed keep prices under control. But it also makes it more likely that the country will fall into a recession.

Still, Fed officials do not expect a slump. The members of the rate-setting committee said on Wednesday that they think the economy will grow by 0.4% on average this year. They think that the jobless rate will rise from 3.6% in February to 4.5%.